Is Bitcoin’s 4-Year Cycle About to Break? Why 2025 Could Change Everything

This time, it might really be different.

For years, Bitcoin has followed a predictable four-year cycle—three years of growth, followed by a painful year of decline. This pattern has shaped every bull and bear market since 2014.

But 2025 might be different.

With a major policy shift from the U.S. government, institutional money pouring in, and the crypto market maturing, we could finally see an end to Bitcoin’s infamous boom-and-bust cycles.

Let’s break it down.

Understanding Bitcoin’s 4-Year Cycle

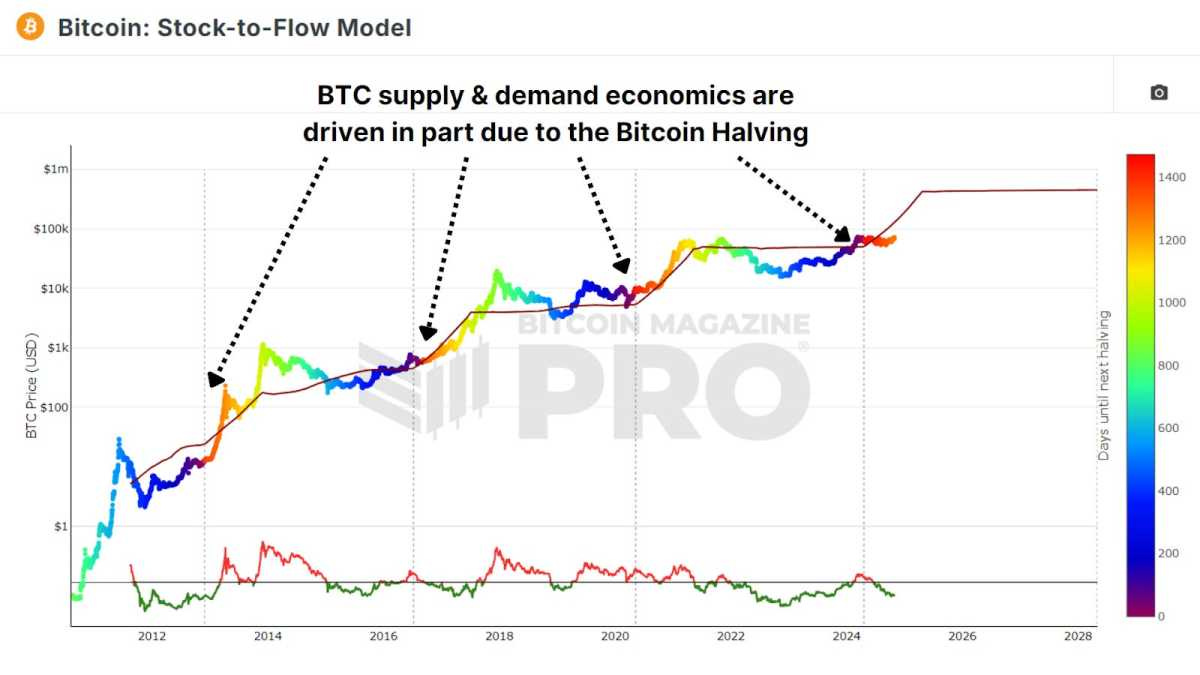

Bitcoin’s price movements have historically been tied to its halving cycle, which occurs every four years. The halving event cuts Bitcoin’s mining rewards in half, reducing the new supply of BTC entering the market. This supply shock has historically led to a bull run about a year later.

The cycle looks something like this:

✅ Year 1: Bear Market (BTC drops 80%+ from its previous all-time high)

✅ Year 2: Accumulation Phase (BTC starts slowly recovering)

✅ Year 3: Bull Market Ignites (BTC breaks previous highs, new capital enters)

✅ Year 4: Parabolic Run & Peak (Exponential gains, then a crash)

We saw this in 2017-2018, again in 2021-2022, and many predicted it would repeat in 2025-2026.

But now, macro factors and government policy are rewriting the playbook.

The Trump Administration’s Game-Changing Crypto Policy

In January 2025, President Trump signed an executive order making digital assets a national priority. This could be the biggest fundamental shift in Bitcoin’s history.

The executive order focuses on:

🚀 Regulatory clarity for institutions

🏦 Stablecoin integration into traditional finance

🇺🇸 A potential U.S. Bitcoin reserve

This marks a massive shift from previous administrations, which either ignored or actively fought crypto adoption.

How This Could Break the Bitcoin Cycle

According to Bitwise CIO Matt Hougan, this new policy framework could extend the current bull market beyond 2026 by bringing in long-term, institutional capital.

Here’s why:

1️⃣ Institutional Demand is Rising – With regulatory clarity, major banks and funds can finally allocate to Bitcoin without compliance concerns.

2️⃣ ETFs Are Just the Beginning – Spot Bitcoin ETFs were the first step. The next wave is crypto-backed lending, staking, and structured financial products.

3️⃣ State & Sovereign Fund Adoption – If the U.S. government establishes a Bitcoin reserve, we could see global governments competing to accumulate BTC.

4️⃣ Stablecoins Go Mainstream – The order could fast-track stablecoin adoption, making crypto payments seamless within traditional finance.

All of this could reduce the extreme volatility of Bitcoin’s past cycles. Instead of wild booms and crashes, we may see steadier, more sustained growth.

What This Means for Investors

The biggest risk in crypto has always been regulatory uncertainty. That’s changing.

With clearer rules, institutions are less hesitant to invest. And when big money moves in, Bitcoin’s price action could shift from retail-driven hype cycles to a more stable asset class.

Does this mean Bitcoin won’t experience corrections anymore? No. But it could mean the extreme -80% crashes we’ve seen in the past become less likely.

The market is evolving. This time might actually be different.

Final Thoughts: Will Bitcoin Break Its Cycle?

If these new policies materialize, we could see a structural shift in Bitcoin’s price dynamics.

The old cycle—driven by speculative hype and retail investors—may be replaced by:

✅ Steady institutional inflows

✅ Government-backed Bitcoin accumulation

✅ Integration into the global financial system

For years, Bitcoin has been dismissed as “too volatile” or “too risky.” But in 2025, the narrative is shifting:

💡 Bitcoin is no longer an outsider—it’s becoming part of the system.

So what do you think? Are we witnessing the end of Bitcoin’s 4-year cycle? Or will history repeat itself once again?

Drop your thoughts in the comments! 👇

🚀 Subscribe to stay ahead of the crypto markets! 🚀

Will institutions gravitate to BTC as a 'store of value' or other alt coins which have superior utility thereby making them a 'superior store of value'?

You make a clear and concise argument why 2025 may well be different for BTC, and all cryptos. Thank you.