Bitcoin: The Ultimate Example of Anti-Fragility

What doesn’t kill Bitcoin only makes it stronger.

The very challenges faced by Bitcoin are what make it thrive—a concept perfectly captured by Nassim Nicholas Taleb’s theory of anti-fragility.

So, what does it mean to be anti-fragile? And how does Bitcoin embody it better than anything else? Let’s explore.👇🏻

What is Anti-Fragility?

The term anti-fragile was introduced by Nassim Nicholas Taleb, a renowned scholar, statistician, and risk analyst, in his book Antifragile: Things That Gain From Disorder.

Taleb describes anti-fragility as a property of systems, individuals, or entities that not only resist chaos and volatility but thrive because of it. Unlike fragile systems, which break under pressure, and robust systems, which endure pressure, anti-fragile systems actually benefit from stress, shocks, and disorder.

Key traits of anti-fragile systems include:

Decentralization: Reducing single points of failure.

Adaptability: Becoming stronger when tested.

Optionality: Leveraging volatility and randomness as opportunities for growth.

Nowhere is this concept more evident than in Bitcoin.

Bitcoin: The Embodiment of Anti-Fragility

Since its creation in 2009, Bitcoin has been declared dead 477 times (according to 99Bitcoins). Yet, each time, it has come back stronger. Bitcoin doesn’t just survive chaos—it thrives on it.

Here’s how:

1. Bans Can’t Stop It

Imagine a currency so powerful that governments around the world have tried to ban it, only to see it grow stronger. Bitcoin has faced bans and restrictions from countries like China, India, and Nigeria. Each time, adoption has surged rather than faltered.

Take Nigeria, for example. Despite the government’s efforts to restrict crypto transactions, Nigerians turned to Bitcoin as a financial lifeline, making the country a global leader in adoption.

Or consider China’s 2021 mining ban, which initially caused a drop in Bitcoin’s hash rate. Within months, mining activity had redistributed globally, making the network even more decentralized and resilient.

2. Volatility Makes It Stronger

In traditional finance, volatility is often seen as a weakness. In Bitcoin, it’s part of the design.

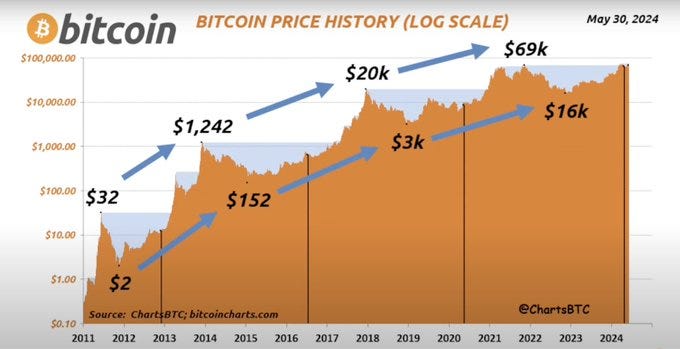

Every bear market has brought education, innovation, and stronger belief among users. And after every crash, Bitcoin has hit new all-time highs:

2020-2021: Record volatility culminated in mainstream adoption and institutional investments.

2023-2024: Despite macroeconomic challenges, Bitcoin remained a preferred hedge against inflation and fiat instability.

Bitcoin thrives on these cycles of doubt and rediscovery. Chaos creates believers.

3. Politicians Can’t Control It

One of Bitcoin’s greatest strengths is its decentralization. Unlike traditional currencies or financial systems, Bitcoin operates without a central authority. No politician, government, or institution can truly control it.

This makes Bitcoin:

Censorship-resistant: Transactions can’t be stopped by borders or regulations.

Global by nature: It belongs to no one, yet it’s accessible to everyone.

Attempts to demonize or control Bitcoin often backfire by highlighting the exact reasons it exists: a trustless, decentralized alternative to fragile systems.

4. It Turns Critics Into Advocates

Skeptics have fueled Bitcoin’s growth. Every article declaring Bitcoin “dead” (there are 477 obituaries and counting) brings more attention to it. As more institutions, investors, and governments realize they can’t tame it, they begin to adopt it.

Think about this: What other asset has been declared worthless hundreds of times and still grown from less than $1 to over $30,000 in 14 years? That’s 30,000% growth, driven by chaos and resilience.

How Bitcoin Compares to Fragile Systems

Fragile systems, like traditional banks or fiat currencies, crumble under stress:

They rely on centralized trust.

They’re prone to collapse in the face of economic shocks (see: 2008 financial crisis).

Bitcoin, on the other hand, was born out of the 2008 crisis. It’s designed to resist these failures and become stronger in the process. Every failure in the traditional system highlights the need for Bitcoin.

Why Anti-Fragility Matters

Taleb explains that anti-fragile systems love randomness and uncertainty. They embrace chaos because it helps them evolve, adapt, and thrive.

Bitcoin doesn’t just survive attacks—it incorporates them into its DNA. Each challenge—whether it’s a ban, a crash, or regulatory scrutiny—makes Bitcoin stronger, more decentralized, and more widely adopted.

Key Takeaways

Bitcoin is the perfect example of anti-fragility:

Every attack makes it stronger.

Every crash educates and builds resilience.

It thrives in chaos and disorder, unlike traditional systems that crumble under stress.

So the next time someone declares Bitcoin “dead,” remember this: Bitcoin isn’t just surviving—it’s thriving. 💥

If you’ve made it this far, what are your thoughts? Is Bitcoin the most anti-fragile asset of our time? Let’s discuss! 🌍⚡

Sources: Nassim Nicholas Taleb’s “Antifragile,” 99Bitcoins, NYTimes, CoinDesk

Matt, This is one of my very favorite books, it's brilliant. Are you going to write another piece on his views of an asymmetric bet as it relates to his investment thesis?